02.21.24

Why Multifamily Investors are Flocking to Ohio: A Look into the State’s Investment Appeal

In recent years, Ohio has emerged as a prime destination for multifamily investors, attracting attention from both national and foreign entities. Behind this surge in interest lies a combination of strategic large-scale investments, favorable affordability metrics, and a promising outlook for returns. Let’s delve into why multifamily investors are increasingly turning their focus to the Buckeye State.

Strategic Large-Scale Investments

Ohio’s appeal as an investment hub has been bolstered by several high-profile ventures by major corporations. Intel’s colossal $20 billion investment in Central Ohio for a new semiconductor facility has garnered significant attention, underlining the state’s technological potential. Moreover, Amazon’s commitment to inject nearly $8 billion into Ohio by 2030 signals confidence in the region’s economic prospects, as highlighted by Governor DeWine.

Ohio’s appeal as an investment hub has been bolstered by several high-profile ventures by major corporations. Intel’s colossal $20 billion investment in Central Ohio for a new semiconductor facility has garnered significant attention, underlining the state’s technological potential. Moreover, Amazon’s commitment to inject nearly $8 billion into Ohio by 2030 signals confidence in the region’s economic prospects, as highlighted by Governor DeWine.

Not to be overshadowed, Mobis North America’s substantial investment in an EV battery manufacturing plant in North Toledo underscores Ohio’s growing significance in the realm of sustainable technology. With over $1 billion earmarked for real estate development projects, cities like Toledo are aggressively rebranding themselves to attract further investment, promising job creation and economic opportunities.

Cleveland, too, is experiencing a surge in investment, with Sherwin Williams spearheading major projects including a new global headquarters and a technology center. With investments totaling nearly $900 million, these developments are poised to reshape the city’s landscape and generate substantial employment opportunities.

Affordability: A Decisive Factor

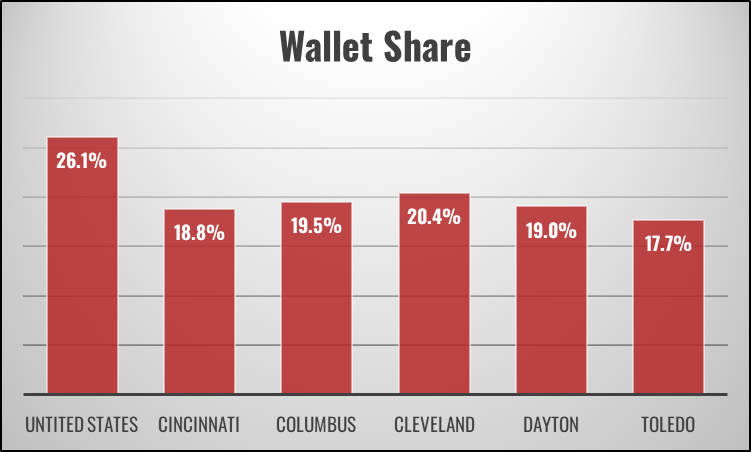

One of Ohio’s standout attributes for multifamily investors is its affordability. Calculated as the ratio of annual rent to median income, Ohio’s major Metropolitan Statistical Areas (MSAs) consistently maintain ratios well below the national average. This affordability index not only ensures a broader tenant pool but also indicates the potential for rent escalation without compromising occupancy rates.

One of Ohio’s standout attributes for multifamily investors is its affordability. Calculated as the ratio of annual rent to median income, Ohio’s major Metropolitan Statistical Areas (MSAs) consistently maintain ratios well below the national average. This affordability index not only ensures a broader tenant pool but also indicates the potential for rent escalation without compromising occupancy rates.

As the gap between homeownership costs and rental expenses widens across the nation, Ohio stands out as a beacon of affordability. Forbes reports that in some markets, the disparity between monthly mortgage payments and rent exceeds $1,000, further underscoring the attractiveness of renting in Ohio’s comparatively affordable market.

Housing Shortage and Investor Optimism

Despite its allure, Ohio grapples with a shortage of new housing construction, driving up demand for existing multifamily properties. With approximately 18,500 units under construction, down nearly 27% from previous periods, the state faces challenges in meeting its housing needs. This scarcity presents an opportunity for multifamily investors to capitalize on the growing demand for rental properties.

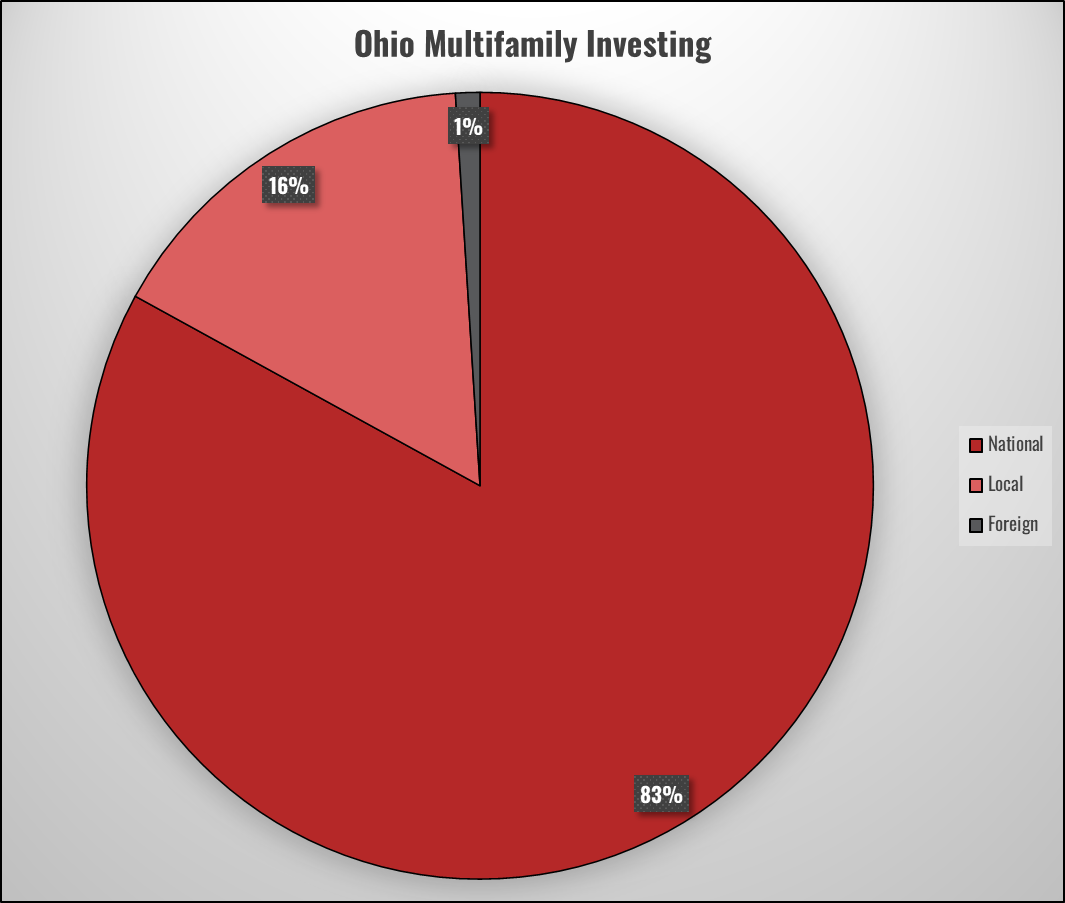

The influx of out-of-state investors underscores the optimism surrounding Ohio’s real estate market. Over the past three years, 70% of the top buyers hail from outside the state, with national and foreign investment comprising 87% of sales volume. This influx of external capital is a testament to Ohio’s potential for robust returns and sustained growth in the multifamily sector.

In conclusion, multifamily investors are increasingly drawn to Ohio’s blend of strategic investments, affordability, and promising returns. With large corporations pouring billions into the state and a favorable affordability index, Ohio offers a compelling proposition for investors seeking to capitalize on the growing demand for rental properties in a dynamic and evolving market landscape.