02.04.20

Chicagoland Multifamily: Where To Invest During Tax Uncertainty

There is a growing consensus that the probability of a recession in 2020 is nearing zero percent, as building permits and existing home sales help to continue the current economic expansion. There is also continued enthusiasm in the City of Chicago and Suburban Chicago multifamily sector, supported by very encouraging demographics and multifamily sales metrics. According to CoStar, Chicago market rents are estimated to grow by 2.3%, and sales prices will grow by 2.25% to $202,000 per unit in 1Q 2020, while the Southwestern Cook County sales prices will also increase 2.25% to $110,000 per unit in 1Q 2020. The vacancy rate will only rise a mere 10 basis points from 6.4% to 6.5%, with that slight increase attributed to unabsorbed new units coming online. Chicagoland is one of the best environments for multifamily housing investment. The Freddie Mac Multifamily 2020 Outlook ranks Chicagoland in the top 10 markets, of 50 US Markets ranked by gross income.

Enough with the rainbows and unicorns. Let’s shift to the elephant in the room: Property tax uncertainty. This risk of increasing, or simply unknown, property taxes is the most common issue cited when I talk with and advise investors on holding, selling or acquiring multifamily properties in Illinois, Cook County and Chicago. While the Cook County Assessor’s Office has ushered in a previously unseen level of ethics, fairness and transparency, the complex nature of how actual tax dollars are calculated (Vis-à-vis new assessments) has created seemingly more uncertainty. There is a quote, and I can never remember whose it is. Still, it really sums up current multifamily investor sentiment regarding property taxes in Cook County: “The misery of uncertainty is worse than the certainty of misery.”

Tax Liability in Chicago, Chicago Ridge and Oak Lawn

Multifamily owners do not have to live with this misery until they receive actual tax billed amounts over the next two years. Like a well operated and maintained multifamily asset, property tax expenses also can be predictable. When a municipality and taxing bodies are well operated, with sound investment, along with stable pension stewardship, you can project future tax liabilities in a more accurate way. Understanding the percent of taxes levied for pension shortfalls, the relationship of total municipal tax as percentage of total, are just a couple of the factors we analyze at when helping owners understand where taxes are trending.

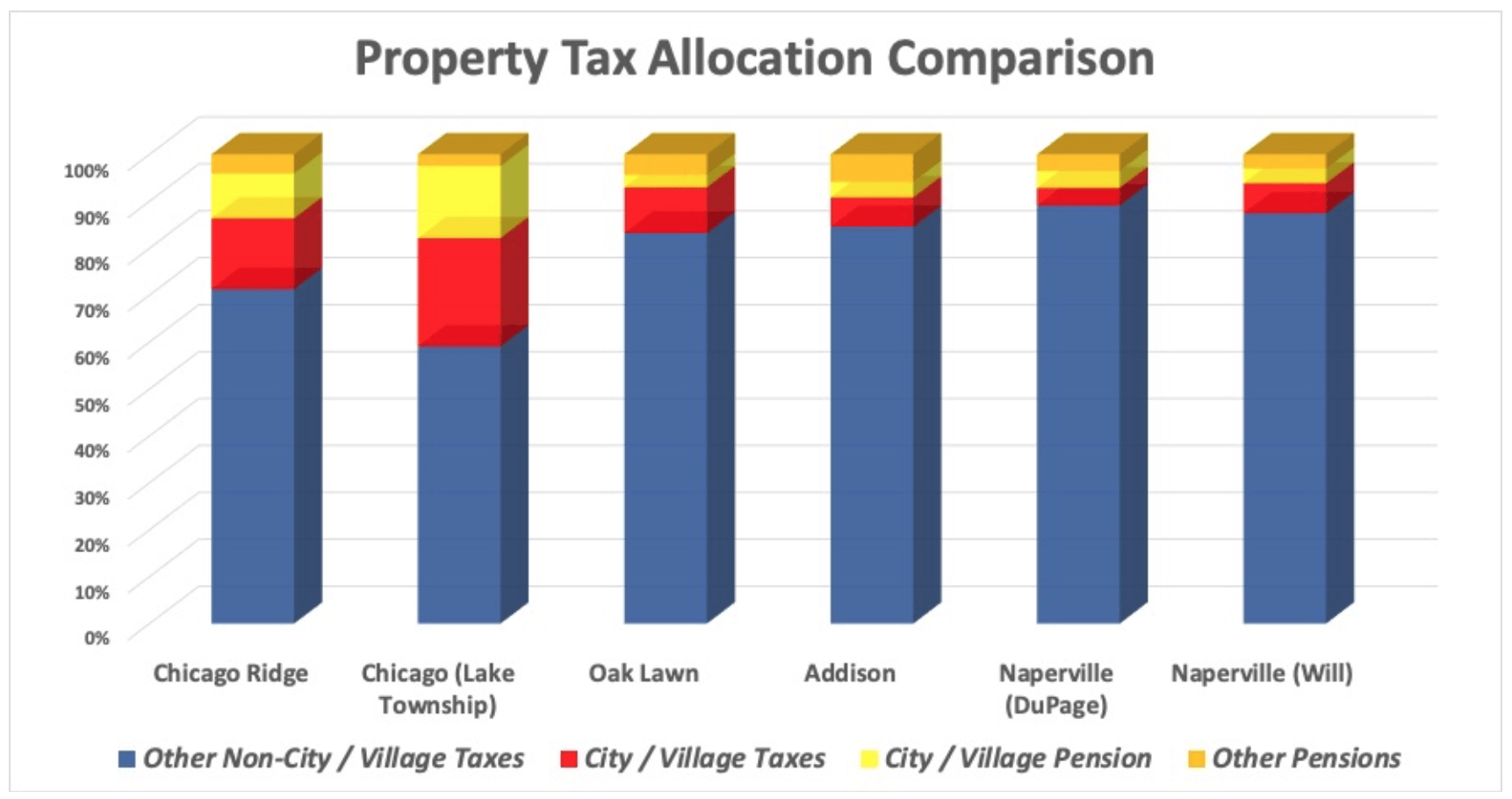

Recently when comparing multifamily properties in Cook County, I was able to quantify and compare multifamily tax liability in Chicago, Chicago Ridge, Oak Lawn and other submarkets, and translate that into a county tax risk index, by submarket.

Owners can use this information to determine which submarkets in Cook County have the highest likelihood to increase the largest operating expense. When comparing areas in DuPage, you can find submarkets that are in similar shape as some areas of Cook and Chicago; conversely, within Will County you can find varying risk within the same town (i.e. Naperville in DuPage versus Will).

Source: Research from Ron Plonis, Kiser Group

Source: Research from Ron Plonis, Kiser Group

With cap rate compression, unit sales prices rising, strong demographics and fundamentals, it’s difficult for owners to determine the best time to capitalize on their holdings when juxtaposing opportunity with tax uncertainty. It’s a metaphorical real estate sun-shower, where the sunshine of low interest rates and rising sales prices are dampened down with the raindrops of property tax confusion.

Buyers and Sellers exist for all multifamily assets, and when the future tax liabilities are pulled apart and indexed by submarket, it increases the owners’ ability to plan when to invest or move equity. Plans to move equity from subpar submarkets, and invest in the best Cook County submarkets, or suburban markets with low tax risk, as well as alternative counties such as Will, Kendall, Kane and DuPage. Major trades are happening every day (1Q 2020 sales already 93% of 4Q 2019), and allowing the uncertainty with taxes to prevent a purchase or sale of an asset in this market can be avoided with the right plan.

I meet with building and portfolio owners of all sizes in Chicagoland every day and help provide clarity and certainty they need in order to confidently acquire, refinance, sell or hold their investments. If you’d like to get some certainty, and see where your assets fall on the “Tax Risk Spectrum”, Schedule a Short Call with me.