12.04.23

Unlocking Opportunities and Navigating Challenges: The Dynamics of Michigan’s Multifamily Real Estate Market

The multifamily real estate scene in Michigan is a vibrant tapestry of opportunities and challenges. While rising interest rates pose a notable hurdle, the market resonates with resilience, offering ample room for growth and investment.

In this article, I delve into the intricacies of Michigan’s multifamily real estate landscape, spotlighting both its hurdles and promising prospects. My aim is to provide a pragmatic, data-backed, and optimistic view of this dynamic market.

Rent Trends

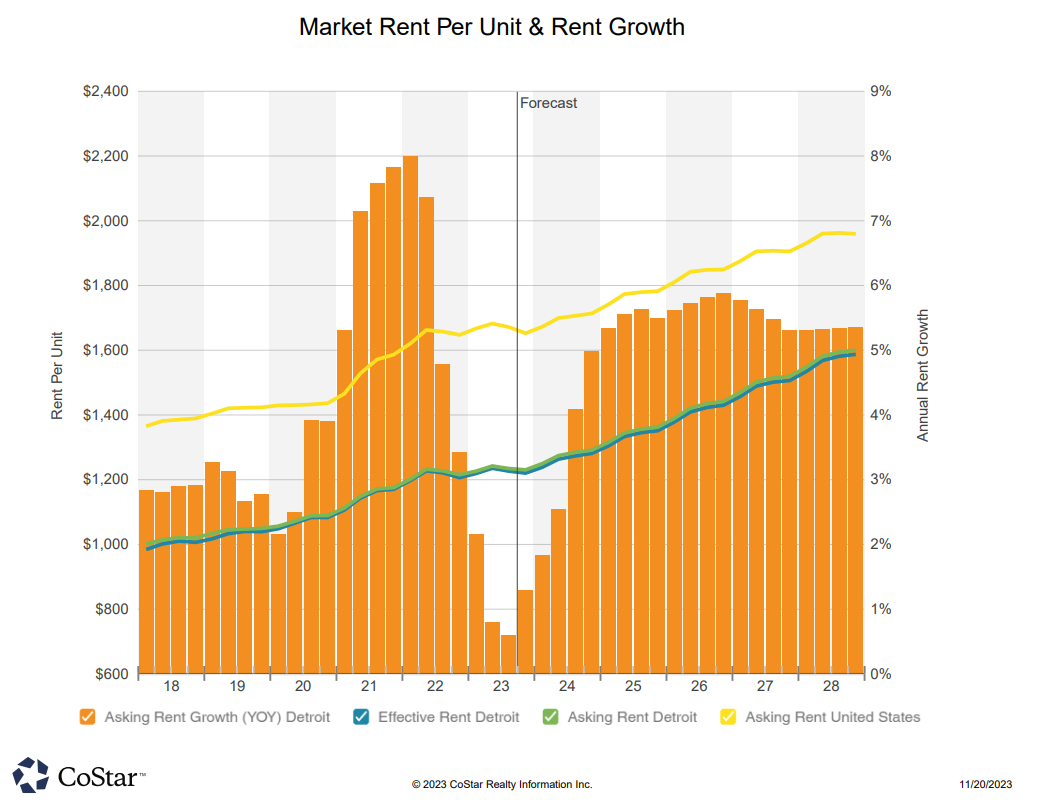

In Q3 of 2023, the average rent in the Detroit area hovers at an affordable $1,230 per month, notably lower than the national average of $1,670 per month. Grand Rapids and Ann Arbor stand at $1,350 and $1,500 per month, respectively. Lansing emerges as the most affordable at $1,110 per month. Despite a slight slowdown, rent prices are projected to rebound, with an estimated 3.8% increase to an average rent price of $1,285 in Q3 of 2024. Additionally, approximately 5,700 units are under construction in the Detroit area, comprising around 2.5% of the market’s current inventory. This trend of under-construction units is poised to rise further into Q1 of 2024 and throughout the new year.

Occupancy in MI

While job growth remains consistent in markets like Midland, Jackson, and Flint, there’s a noticeable incline in job growth in Ann Arbor, Lansing, and Grand Rapids. The ongoing enthusiasm for single-family home prices and the rise in home loan rates have proven beneficial for multifamily property owners. The chart below shows the current rent growth alongside the current job growth across all Michigan markets in the last 12 months.

Current Capital Markets

The impact of rising interest rates on the multifamily real estate market is becoming palpable, influenced by the strong national economy. Though adapting to these changes might seem gradual initially, many anticipate further rate increases, slowing down the pace of multifamily real estate transactions.

Sellers are holding onto past price expectations while buyers actively seek properties aligning with current market conditions. This discrepancy is evident in reports projecting a 57.35% decrease in sales transactions in the last 12 months in the current Detroit market.

To better assist our clients, we’ve adjusted our valuation methods based on inputs from appraisers and lenders. The need to consider pre-2023 properties as outdated benchmarks due to changing debt market conditions has been a recurring theme. Our valuations, particularly concerning the debt service coverage ratio, have posed challenges, resulting in new debt loan-to-value ratios ranging from 50% to 67% throughout Q1-Q3 of 2023. This has attracted limited buyer interest, leading to an average LTV of approximately 83% for the properties reviewed.

Market Predictions

Looking ahead, despite capital market challenges, Michigan’s multifamily real estate market is poised for continued expansion. The scarcity of properties has triggered off-market offers and record-breaking prices in specific submarkets. The state’s active promotion of job market growth through public and private investments and business-friendly initiatives benefits both renters and property owners.

Maintaining a balanced market landscape might witness occasional fluctuations, yet Michigan is projected to sustain robust and stable growth. This growth is propelled by strong demand for value-add properties and competition from a diverse group of investors, including local owners and newcomers from out-of-state.

Though deal volume might remain subdued in the coming year, by Q4 of 2024, a return to the market equilibrium experienced before and during the early stages of the pandemic is anticipated.

How Can We Help?

If you need assistance in assessing the value of your property or require proprietary market information and data, please feel free to reach out to Will Mast.