02.06.19

Opportunity Zones: What to know before investing in the latest real estate trend

By Aaron Sklar, Kiser Group

As a multifamily broker focused on the South Side of Chicago, it’s safe to say that demand for multifamily product is insane. Aside from the area already being hot, buildings are appreciating and cash flowing better than other areas in Chicago – and the country. Now, add in the Opportunity Zone designation; instantly we have new investor interest flooding in causing our phones to ring off the hook. This frenzy has people breaking price-per-door records nearly on a monthly basis. But before you jump into the mix, here are three things you need to consider about South Side multifamily investing.

#1: Unlike A Stock, These Buildings And Residents Need Attention

First-time real estate investors are common on the south side of Chicago. The cost to enter the market is lower than Wicker Park, Lincoln Park and other established neighborhoods. And arguably, the returns are a lot better, too. Whether you are a first-time real estate investor or first-time South Side investor, we always tell our clients that they need to understand what they are investing in. Simply: properties require maintenance and residents need to be taken care of. Buying an apartment building is not like buying a stock of Apple.

#2: Property Management Will Make Or Break Your Investment

For the property to qualify as an opportunity zone, the Census Tract has a combination of median household income just over $30,000, unemployment rate higher than 20% and a poverty rate of 30% or more. Unless you are a seasoned investor with property managers on staff, we always recommend hiring a third-party management firm for your South Side investment. Thinking you can cut costs on property management is a recipe for disaster. With properties split nearly 50/50 between market rate and subsided renters, this may be a new renter profile that you’ve never worked with before. Investors not accustomed to allocating resources to managing subsidies may be caught off guard.

#3: There Is Fine Print To Read

If you’ve read the headlines about Opportunity Zones and decided to invest in one, I suggest that you do some more digging and talk to people that understand the fine print. There have been a number of investors jumping the gun when it comes to investing in these properties. While there are many other reasons to invest in South Side product, for those looking for the tax incentives, there is a lot of heavy lifting to be done. We are coaching our clients every day about what we are learning, and truly, there isn’t a perfect description out there with all of this information sewed up in one easy-to-read document.

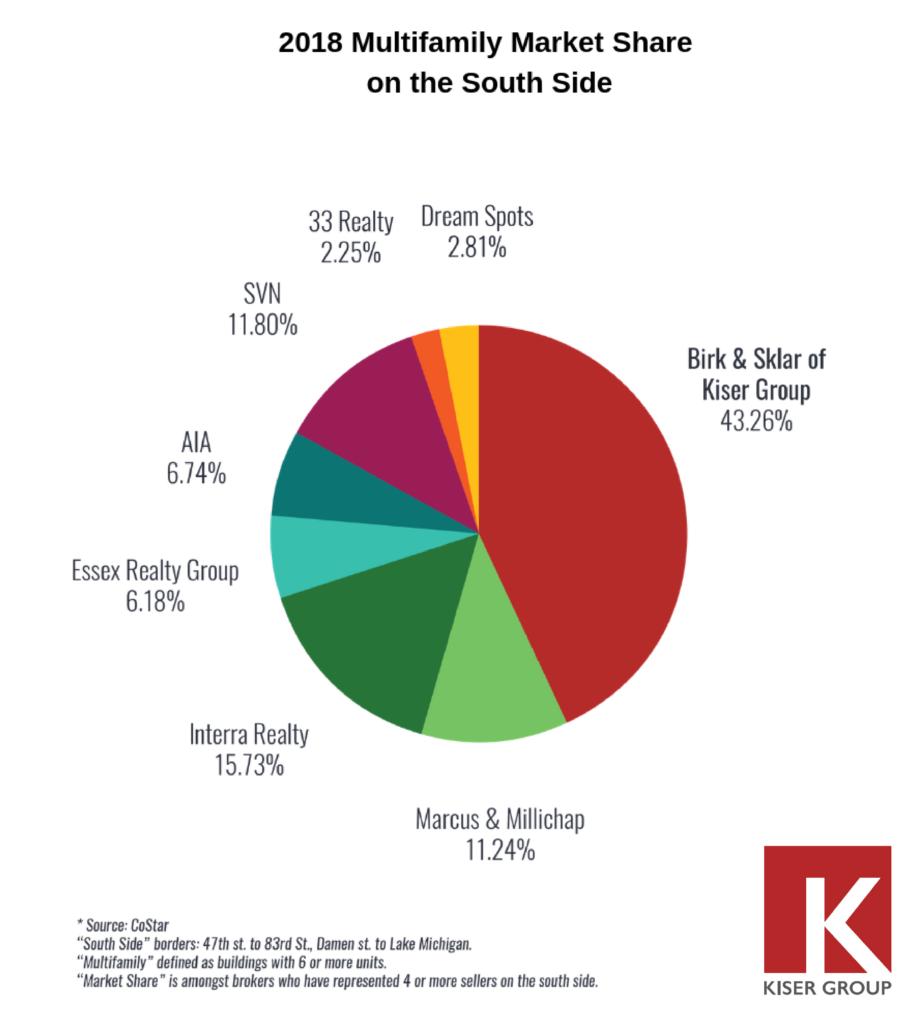

Last year, we sold 54 multifamily buildings throughout Chicago’s south side neighborhoods. According to CoStar data, this was the largest market share for any brokerage or broker team working in the area, accounting for more than 43% of the area’s transactions. If you are considering investing in these neighborhoods, whether for Opportunity Zones, cash flow or appreciation, give me a call.